From tomorrow, September 1, the new VAT rates established by Royal Decree-Law 20/2012 of July 13, published in the BOE on July 14, 2012, will enter into force. With regard to the rental market and purchase/sale of real estate, this change will affect as follows:

a) Rental of homes

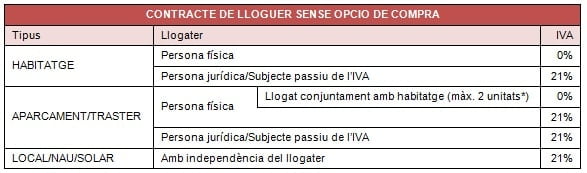

Home rentals to individuals maintain the rate of 0%, while rentals to legal entities/subjects liable for VAT, go from 18% to 21%.

b) Rental of parking spaces/storage rooms

In the case of car parks/storage rooms, the VAT rate goes from 18% to 21%. Car parks/storage rooms rented with homes (up to a maximum of 2 units), maintain the 0% rate, as long as the tenant is a natural person.

b) Rental of premises/buildings/lots

The VAT rate goes from 18% to 21%.

You can consult the VAT rate applicable depending on the type of property and tenant in the following table:

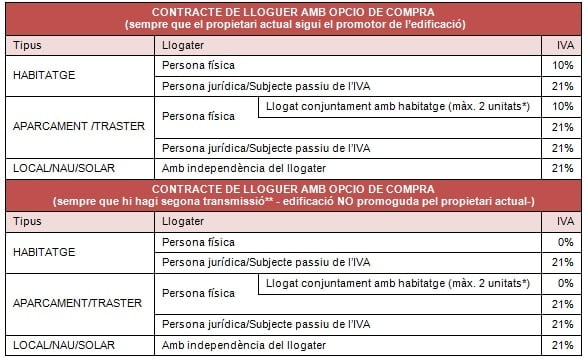

Rent with purchase option

In those cases where the VAT rate was 0%, this remains. In cases where it was 8%, it becomes 10%. The following table lists these cases and indicates the applicable VAT rate depending on the type of property, the tenant and the developer of the building:

VAT for the acquisition of new homes will remain at 4% during 2012. However, from 2013, 10% will apply. Purchases/sales previously subject to 18%, mainly of parking lots, premises, warehouses and plots, now have a rate of 21%.